Business

Interview with Jason Ho, CEO of Teklium: A Vision for the Future of Technology

By Mj Toledo

There is a wealth of experience behind Teklium, and it is embodied in its chief executive officer (CEO), Jason Ho. His educational foundation was laid at National Chiao Tung University and Pennsylvania State University, where he developed his skills in electrical engineering. With over 400 patents to his name, he has played a key role in advancing semiconductor technologies and artificial intelligence (AI).

From leading custom chip design for the F35 Fighter Jet to innovating at Teklium, Ho’s work has been adopted by major corporations worldwide. In this interview, he shares his vision for the future of technology and how Teklium’s developments fit into this broader landscape.

Q: Hi, Jason. For those who may not be familiar with Teklium, could you tell us more about your company?

Jason Ho: Certainly. Teklium is a technology company focused on improving AI and semiconductor technologies. Our mission is to create self improving AI systems and hardware that can tackle various technological challenges and shape the future of multiple industries.

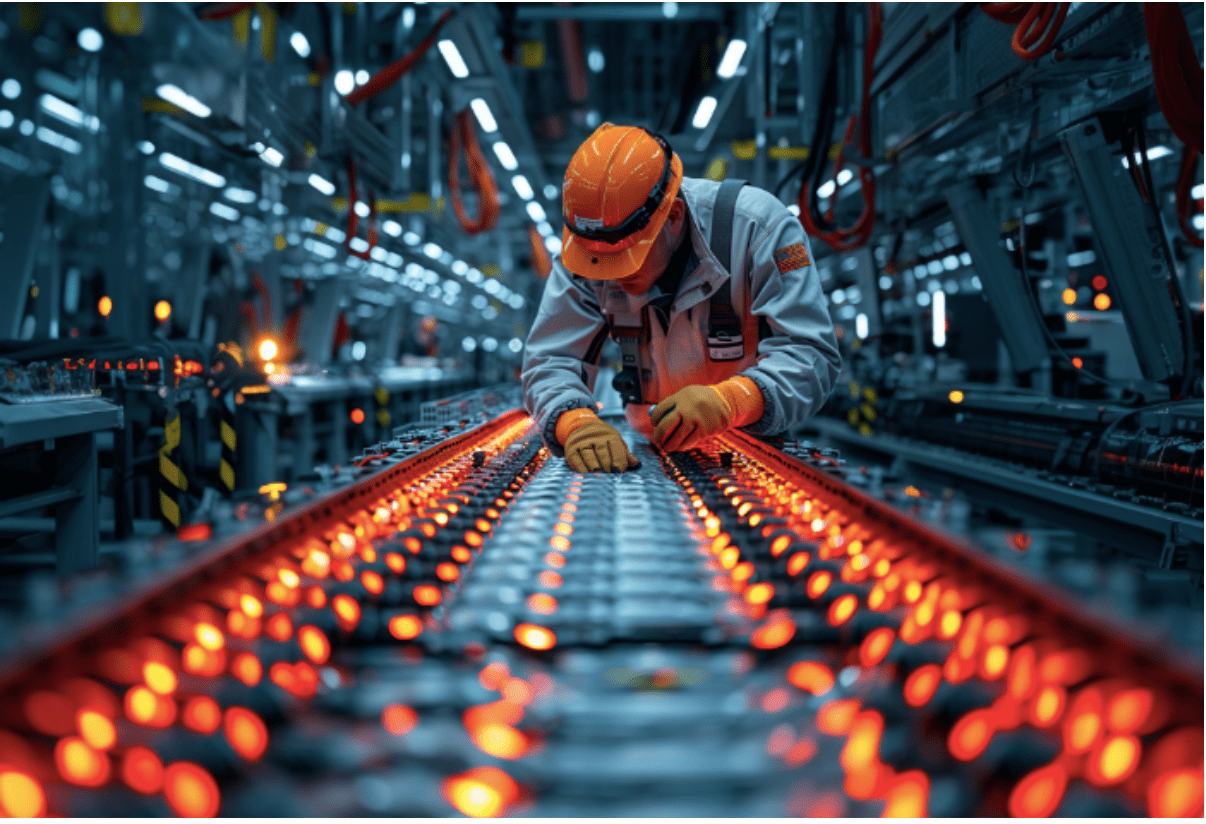

Q: You hold over 400 international patents, with one of your most notable innovations being hydrogen battery technology. What inspired you to promote this sustainable transportation solution?

Jason Ho: I’ve always been deeply interested in finding sustainable energy solutions, especially in transportation. Traditional lithiumion batteries have clear limitations, both in terms of performance and their environmental impact due to resource mining. Hydrogen batteries present a promising alternative, offering both environmental benefits and faster refueling times, which could make electric vehicles more practical and appealing.

Q: What drove you to focus on hydrogen battery technology specifically?

Jason Ho: My collaboration with Mark Bayliss, President of Visual Link, played a significant role. Mark introduced the concept of a closed loop hydrogen system, and our joint efforts resulted in the development of a hydrogen battery technology that we believe can provide a clean and safer alternative to lithiumion batteries. This inspired me to continue refining the technology, working with Visual Link to bring it to market.

Q: How do you see your company’s hydrogen battery technology impacting the electric vehicle industry in the next decade?

Jason Ho: I’ve thought about this a lot. Our hydrogen battery technology has the potential to revolutionize the electric vehicle industry by offering a more efficient and sustainable energy source. The ability to refuel quickly, combined with the technology’s adaptability to a wide range of temperatures, could make electric vehicles far more practical and attractive to consumers in the long term.

Q: Can you explain the significance and potential impact of Teklium’s closed loop hydrogen energy system on global energy consumption?

Jason Ho: The closed loop hydrogen energy system is groundbreaking because it enables onsite hydrogen generation through water electrolysis, eliminating the need for external supply chains. This drastically lowers energy consumption and minimizes environmental impact by recycling water in a continuous loop. The system offers an environmentally friendly solution for industries beyond transportation, including energy storage and telecommunications.

Q: What challenges do you foresee in scaling up hydrogen battery production, and how does Teklium plan to address them?

Jason Ho: Scaling up hydrogen battery production comes with significant challenges, including the development of necessary infrastructure, reducing production costs, and ensuring safety standards. At Teklium, we plan to address these obstacles by partnering with industry leaders to build the required infrastructure and by investing in research to lower costs. We’re also committed to implementing rigorous safety protocols to ensure the technology performs reliably.

Q: How does Teklium’s strategy for AI infrastructure differ from traditional approaches?

Jason Ho: At Teklium, we’re taking a different approach by exploring ways to develop advanced materials and technologies that could improve the performance and efficiency of AI infrastructure. We’re focused on moving beyond traditional silicon based systems and envision a future where we can create three dimensional chip structures that significantly reduce data movement and energy consumption. By integrating memory and processing capabilities, we believe we can revolutionize AI workloads.

Q: Teklium has ambitious plans for extending Moore’s Law. Can you elaborate on how these plans could transform the semiconductor industry?

Jason Ho: Siliconbased chips are nearing their physical limits, so we’re exploring technologies that could allow us to scale transistor density both vertically and horizontally. By adopting these new approaches, we aim to significantly increase chip performance and, in doing so, challenge the traditional expectations of Moore’s Law. We also envision a future where chips are reusable and can be reprogrammed over decades, which could reshape the semiconductor industry’s business model in terms of sustainability and efficiency.

Q: What environmental benefits could Teklium’s technologies bring, particularly in reducing carbon emissions and resource consumption?

Jason Ho: Our innovations could have a profound impact on the environment. We’re committed to developing technologies that reduce resource consumption and minimize waste. By creating more efficient manufacturing processes and extending the lifespan of chips, we hope to significantly reduce electronic waste. Our work on AI infrastructure could also cut energy consumption in data centers by as much as 60%, which would translate into substantial reductions in carbon emissions. And, of course, our hydrogen battery technology offers a clean energy storage solution that could accelerate the adoption of renewable energy sources.

Q: Aside from electric vehicles, what are some other exciting applications of Teklium’s hydrogen battery technology?

Jason Ho: While electric vehicles are an obvious application, there are so many more exciting possibilities. Our hydrogen batteries could serve as large scale energy storage solutions, balancing grid loads and supporting renewable energy sources like wind and solar power. They could also power remote cell towers and data centers in areas where traditional power sources are unreliable. In aerospace, these batteries could enable long range drones and even electric aircraft. The potential applications in disaster relief and military operations, where portable and reliable energy is critical, are also very exciting.

Q: How does your collaboration with companies like Nantero and Visual Link advance Teklium’s technological developments?

Jason Ho: Our collaboration with Nantero is allowing us to explore advanced memory architectures, while our partnership with Visual Link offers crucial insights into practical applications and market needs. Visual Link also helps us navigate regulatory challenges, ensuring our innovations are commercially viable and compliant with industry standards.

Q: Teklium is involved in the concept of AI City in partnership with West Virginia Data Center Group. Can you tell us more about the vision for this project?

Jason Ho: AI City is an ambitious concept that we’re working on with the West Virginia Data Center Group to turn into reality. The idea is to create an intelligent infrastructure that incorporates cutting edge technologies in AI and data centers, optimizing everything from energy usage to communication networks. We envision a city that can learn and adapt to the needs of its residents, reducing inefficiencies and improving quality of life. It’s still in the planning stages, but we’re confident it can become a reality in the near future.

Q: What are your long term goals for Teklium, and how do you see your inventions influencing future generations?

Jason Ho: My long term vision for Teklium is to become a leader in sustainable technology solutions. We aim to continue pushing the boundaries of AI, semiconductor technology, and energy solutions. I want our innovations to inspire future generations to tackle global challenges like climate change and resource scarcity. Ultimately, I hope Teklium’s work contributes to a more connected and sustainable world.

While Teklium’s advancements may take time to fully realize, they open up exciting possibilities for addressing critical challenges like energy consumption and sustainability. Under Jason Ho’s leadership, Teklium is poised to make a significant impact on the future of technology and the environment.

Business

13 Reasons Investors Are Watching Phoenix Energy’s Expansion in the Williston Basin

As energy security becomes a growing priority in the United States, companies focused on domestic oil production are gaining attention from investors. One such company is Phoenix Energy, an independent oil and gas company operating in the Williston Basin, a prolific oil-producing region spanning North Dakota and Montana.

Phoenix Energy has established itself as a key player in this sector, expanding its footprint while offering structured investment opportunities to accredited investors. Through Regulation D 506(c) corporate bonds, the company provides investment options with annual interest rates ranging from 9% to 13%.

Here are 13 reasons why Phoenix Energy is attracting investor interest in 2025:

1. U.S. energy production remains a strategic priority

The global energy landscape is evolving, with a renewed focus on domestic oil and gas production to enhance economic stability and reduce reliance on foreign energy sources. The Williston Basin, home to the Bakken and Three Forks formations, continues to play a critical role in meeting these demands. Phoenix Energy has established an operational footprint in the basin, where it is actively investing in development and production.

2. Investment opportunities with fixed annual interest rates

Phoenix Energy bonds offer accredited investors annual interest rates between 9% and 13% through Regulation D 506(c). These bonds help fund the company’s expansion in the Williston Basin, where it acquires and develops oil and gas assets.

3. Record-breaking drilling speeds in the Williston Basin

Phoenix Energy has made significant strides in drilling efficiency, ranking among the fastest drillers in the Bakken Formation as of late 2024. By reducing drilling times, the company aims to optimize operations and improve overall production performance.

4. Expansion of operational footprint

Since becoming an operator in September 2023, Phoenix Energy has grown rapidly. As of March 2025, the company has 53 wells drilled and 96 wells planned over the next 12 months.

5. Surpassing production expectations

Phoenix Energy’s oil production has steadily increased. By mid-2024, its cumulative production had exceeded 1.57 million barrels, outpacing its total output for 2023. The company projected an exit rate of nearly 20,000 barrels of oil equivalent per day by the end of March 2025.

6. High-net-worth investor offerings

For investors seeking alternative investments with higher-yield opportunities, Phoenix Energy offers the Adamantium bonds through Reg D 506(c), which provides corporate bonds with annual interest rates between 13% and 16%, with investment terms ranging from 5 to 11 years, and a minimum investment of $2 million.

7. Experienced team with industry-specific expertise

Phoenix Energy’s leadership and technical teams include professionals with decades of oil and gas experience, including backgrounds in drilling engineering, land acquisition, and reservoir analysis. This level of in-house expertise supports the company’s ability to evaluate acreage, manage operations, and execute its long-term development plans in the Williston Basin.

8. Focus on investor communication and understanding

Phoenix Energy prioritizes clear investor communication. The company hosts webinars and provides access to licensed professionals who walk investors through the business model and operations in the oil and gas sector. These efforts aim to help investors better understand how Phoenix Energy deploys capital across mineral acquisitions and operated wells.

9. Managing market risk through strategic planning

The energy sector is cyclical, and Phoenix Energy takes a structured approach to risk management. The company employs hedging strategies and asset-backed financing to help mitigate potential fluctuations in the oil market.

10. Commitment to compliance

Phoenix Energy conducts its bond offerings under the SEC’s Regulation D Rule 506(c) exemption. These offerings are made available exclusively to accredited investors and are facilitated through a registered broker-dealer to support adherence to federal securities laws. Investors can review applicable offering filings on the SEC’s EDGAR database.

11. Recognition for business practices

As of April 2025, Phoenix Energy maintains an A+ rating with the Better Business Bureau (BBB) and is a BBB-accredited business. The company has also earned strong ratings on investor review platforms such as Trustpilot and Google Reviews, where investors often highlight clear communication and transparency.

12. A family-founded business with a long-term vision

Led by CEO Adam Ferrari, Phoenix Energy operates as a family-founded business with a focus on long-term investment strategies. The company’s leadership emphasizes responsible growth and sustainable development in the Williston Basin.

13. Positioned for long-term growth in the oil sector

With U.S. energy demand projected to remain strong, Phoenix Energy is strategically positioned for continued expansion. The company’s focus on efficient drilling, financial discipline, and structured investment offerings aligns with its goal of building a resilient and growth-oriented business.

Final thoughts

For investors looking to gain exposure to the U.S. oil and gas sector, Phoenix Energy presents an opportunity to participate in a structured alternative investment backed by the company’s operational expansion in the Williston Basin.

Accredited investors interested in learning more can attend one of Phoenix Energy’s investor webinars, which are hosted daily throughout the week. These sessions provide insights into market trends, risk management strategies, and investment opportunities.

For more information, visit the Phoenix Energy website.

Phoenix Capital Group Holdings, LLC is now Phoenix Energy One, LLC, doing business as Phoenix Energy. The testimonials on review sites may not be representative of other investors not listed on the sites. The testimonials are no guarantee of future performance or success of the Company or a return on investment. Alternative investments are speculative, illiquid, and you may lose some or all of your investment. Securities are offered by Dalmore Group member FINRA/SIPC. Dalmore Group and Phoenix Energy are not affiliated. See full disclosures.

This article contains forward-looking statements based on our current expectations, assumptions, and beliefs about future events and market conditions. These statements, identifiable by terms such as “anticipate,” “believe,” “intend,” “may,” “expect,” “plan,” “should,” and similar expressions, involve risks and uncertainties that could cause actual results to differ materially. Factors that may impact these outcomes include changes in market conditions, regulatory developments, operational performance, and other risks described in our filings with the U.S. Securities and Exchange Commission. Forward-looking statements are not guarantees of future performance, and Phoenix Energy undertakes no obligation to update them except as required by law.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free