Health

Demystifying Health Insurance: Insights from Celia Reeves for Making Informed Choices for Better Care

Making informed choices for better care starts with a clear understanding of your options and a careful evaluation to ensure the best possible outcomes. Health insurance plays a crucial role in mitigating the risk of accumulating medical debt. To make the most informed decisions, begin by consulting reliable sources and seeking expert opinions. Engaging with healthcare professionals to discuss your specific needs and preferences allows you to weigh the benefits, risks, and costs associated with each option. Additionally, staying updated on the latest advancements and treatments is essential. By actively participating in the decision-making process and staying well-informed, you can enhance your care experience and achieve more personalized, effective results.

Navigating the complex world of health insurance can be daunting, given the wide array of plans and their intricate details. Yet, understanding the different types of health insurance policies and their implications is crucial for making informed decisions that not only enhance the quality of your care but also safeguard you against unexpected medical expenses. Alarmingly, about four in ten adults (41%) report being burdened by debt from unpaid medical or dental bills. The high cost of care is a significant barrier, with 9.3% of adults in 2022 avoiding doctor visits due to financial concerns. Simplifying these key aspects of health insurance—such as various plan types, common pitfalls, and effective strategies for selecting the most suitable coverage—is essential for better financial and health outcomes.

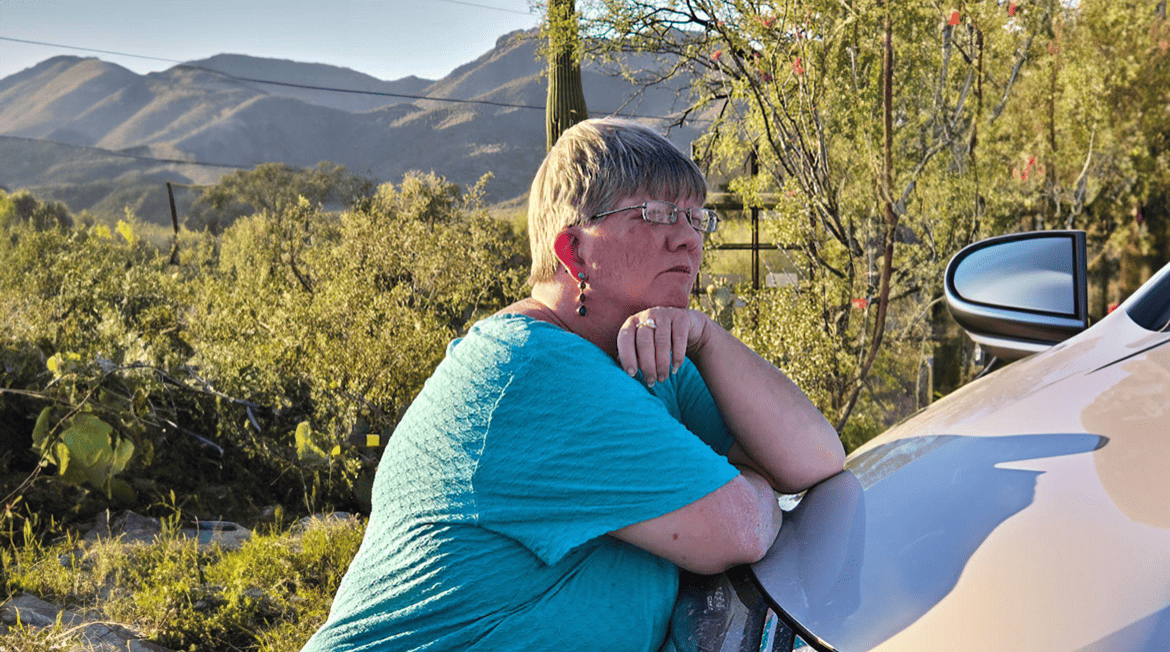

Amidst these complexities, Celia Reeves, also known as Celia “Cici” Reeves, the dynamic CEO and founder of Medical Coding Mama, provides a powerful example of how personal experiences can shape professional expertise. As CEO of Medical Coding Mama, Celia’s journey began with a profound personal experience: the support she received from doctors during her late husband’s battle with cancer. Inspired by this, she pursued a career in medical coding, dedicating herself to her studies and earning national certification in 2009. Her career flourished in Tucson, Arizona, where she worked with the state’s first female urologist and later founded Medical Coding Mama in 2016.

This venture allowed her to combine her coding knowledge with her experiences as a single parent, furthering her impact on the medical coding community. Today, Celia continues to excel in her field, finding joy in Arizona sunsets and spending time with her teenage daughter, all while contributing significantly to the medical coding community. Her story underscores the tangible effects of healthcare on individuals’ lives, bridging the gap between the abstract intricacies of insurance and the real-world impact of medical care.

Types of Health Insurance Plans

Health insurance plans come in various forms, with Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) being two of the most common.

- HMOs require members to choose a primary care physician (PCP) and get referrals from this PCP to see specialists. While these plans often have lower premiums and out-of-pocket costs, they limit access to healthcare providers within the HMO’s network.

- PPOs on the other hand, offer greater flexibility. Members can see any healthcare provider without a referral, though staying within the network reduces out-of-pocket costs. PPOs typically have higher premiums but provide more freedom in selecting providers and accessing services.

Another option is Co-operative health plans (co-ops), which are member-run organizations operating on a non-profit basis. These plans can offer more affordable coverage through collective bargaining, but they vary significantly in structure and coverage, making thorough research essential.

Avoiding Unexpected Medical Bills

Celia highlights the importance of thoroughly understanding your health insurance policy to prevent unexpected medical expenses. “I admit, the policy can be tedious to read, but skipping it can lead to more trouble than it’s worth. It will clearly outline what’s covered and what isn’t,” she explains.

She advises reviewing your coverage details to understand which services, treatments, and medications are included. Pay close attention to whether your plan uses in-network or out-of-network providers, as opting for out-of-network care often results in higher costs. Additionally, familiarize yourself with deductibles, copayments, and coinsurance rates to better budget for medical expenses and avoid financial surprises.

Common Pitfalls in Choosing a Health Insurance Plan

One significant pitfall is choosing a plan based solely on its cost. While lower premiums may be appealing, they often come with trade-offs like higher deductibles or limited coverage. Another common mistake is not fully understanding what is covered under the policy. This can lead to discovering gaps in coverage only after incurring medical expenses.

To avoid these issues, focus on “non-negotiables”—the crucial services and benefits that must be included in your plan based on your health needs. Prioritizing these ensures that your chosen plan adequately covers necessary treatments and services.

Comparing Health Insurance Plans

When selecting a health insurance plan, Celia emphasizes the importance of considering several key factors to ensure you choose the one that best fits your needs.

First, be transparent about any pre-existing conditions to evaluate how effectively the plan addresses your specific health concerns. Next, verify that the plan covers your medications and understand how these are categorized in the formulary, as this will influence your out-of-pocket expenses. Additionally, compare the plan’s coverage options for specialist care, emergency services, and preventive care to ensure it aligns with your overall healthcare requirements.

Resources for Understanding Health Insurance

Understanding your health insurance benefits becomes much simpler with the right resources. As Celia advises, don’t hesitate to reach out to the insurance professionals who sold you the policy—they’re there to answer your questions and can act as a crucial link between you and the insurer, especially if any issues arise with your coverage. The Summary of Benefits and Coverage (SBC) is another essential tool, offering a clear overview of key policy details to help you quickly grasp the important features and limitations. Additionally, online tools and calculators allow you to compare different plans based on your specific health needs and financial situation, ensuring you select the best option for your circumstances.

Making informed choices about health insurance involves understanding the types of plans available, recognizing the importance of policy details, and being aware of common pitfalls. By carefully comparing options and utilizing available resources, you can select a plan that best meets your healthcare needs and financial constraints.

Health

Dr. Rajesh Bindal: Revolutionizing The Future Spinal Care

Spinal care is undergoing a period of change, driven by patient-centric demands, emerging technologies, and a more profound understanding of musculoskeletal health. Healthcare providers such as Dr. Rajesh Bindal are rethinking traditional surgical methods, focusing instead on minimally invasive techniques that prioritize faster recovery and lower complications.

With tools like telemedicine and wearable tech, access to care is broadening, allowing for continuous monitoring and remote management of spine conditions. Simultaneously, data-driven diagnostics and AI are enhancing precision in treatment planning, while interdisciplinary collaboration ensures that care is comprehensive and personalized.

Minimally Invasive Techniques and Their Benefits

Minimally invasive spine procedures are becoming the preferred choice in modern care. Surgeons now rely on techniques that allow smaller incisions, leading to less tissue damage and quicker recovery times. Patients often return to daily routines faster compared to those who undergo traditional open surgeries, and the need for less general anesthesia further reduces associated risks.

Procedures such as endoscopic discectomy and laser-assisted spinal decompression are gaining traction in outpatient settings. These options carry fewer risks and often reduce the need for prolonged hospital stays. As a result, both patient satisfaction and clinical efficiency have improved immensely.

What once required long recovery periods is now being treated with same-day procedures. This shift is not only changing how surgeries are performed but also how treatments are integrated into overall patient wellness. The trend also reflects a broader shift toward value-based care models within the healthcare system.

Diagnostic Technology and Data-Driven Insights

High-resolution imaging tools like MRI and CT scans have become central to accurate spine assessments. These technologies provide detailed views of spinal structures, helping specialists detect abnormalities that might be missed through physical exams alone. In complex or chronic cases, such imaging helps trace the root of persistent symptoms more effectively.

Artificial intelligence is adding another layer of precision by analyzing patterns in imaging data and patient history. With AI-assisted tools, clinicians are developing more targeted treatment plans that account for individual anatomy and risk factors. Early intervention is now more achievable thanks to these innovations. When spine conditions are caught in earlier stages, patients often avoid surgery altogether or benefit from less invasive interventions.

Expanding Access Through Telemedicine and Remote Care

Virtual spine consultations are helping bridge the gap between patients and specialists, especially in rural or underserved regions. Video-based appointments allow for quicker evaluations, timely follow-ups, and better continuity of care without requiring travel. These innovations have proven especially useful during times when in-person visits are limited, such as public health emergencies.

Wearable devices that track posture, movement, and pain levels are now contributing to real-time monitoring. These tools give providers valuable data that can influence treatment decisions, especially when in-person visits are limited or unnecessary. Remote apps also help patients stay consistent with prescribed rehabilitation exercises.

Despite these advancements, some cases still demand hands-on assessment or surgical intervention. The key lies in blending digital convenience with careful clinical judgment to ensure patients receive the most appropriate care. Providers must be trained to know when to escalate care to in-person settings, ensuring patient safety is never compromised.

Putting Patients at the Center of Spinal Care

Modern care is moving away from one-size-fits-all approaches. More providers are focusing on understanding a patient’s lifestyle, goals, and emotional well-being as part of the treatment strategy. Addressing the mental and physical aspects of chronic spine pain leads to more sustainable outcomes. This approach empowers patients to become active participants in their recovery.

Integrated care teams that include physical therapists, pain management specialists, and behavioral health professionals are becoming more common. This collaboration helps patients stay engaged in their recovery and builds a stronger therapeutic alliance between providers and individuals. Response to treatment tends to improve when patients feel heard and supported throughout the process.

Training, Innovation, and Future Directions

Medical training is evolving alongside advancements in spine care. Surgeons and clinicians are learning to work with robotics, navigation systems, and biologics that weren’t part of traditional education just a decade ago. Simulation-based learning and virtual reality platforms are also being used to enhance skills.

As new therapies emerge—from regenerative injections to AI-assisted surgical robotics—ongoing education is crucial. Providers must not only master new tools but also develop communication skills that allow them to explain complex options in relatable terms. This new wave of technology demands both technical proficiency and empathetic patient interaction.

Looking ahead, policy reforms may further shape access and innovation in spine treatment. These changes could influence everything from insurance coverage to how new procedures are adopted in mainstream care. Continuous collaboration between clinicians, tech developers, and policymakers will be essential to ensure the best outcomes for patients.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free