Business

David Seruya: How to Prevent Burning Out When Running a Business?

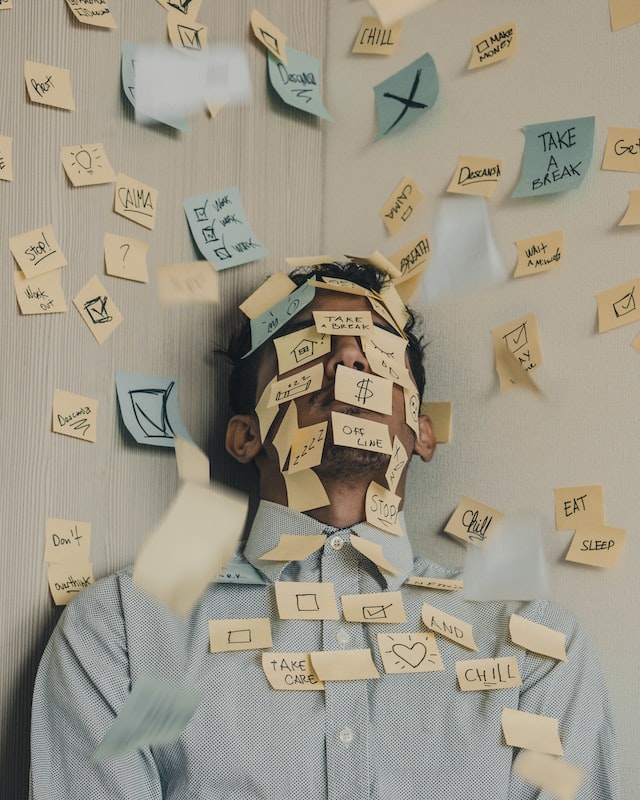

Burnout does not only deal with the body but also with one’s mind and emotions. It’s likely to occur when you’re faced with repeatedly stressful situations — which is common for business owners who have a lot of responsibilities on their shoulders.

Suffice to say that, as a business owner, burnout is something that should be prevented at all costs. After all, you not only have to take care of yourself but also the men and women that you have working under you.

For David Seruya, who has started up several businesses, the stress of running a business is certainly not new. As a result, he’s cultivated his own methods of preventing burnout to ensure that he can continue to run his business smoothly:

5 Unique Ways to Preventing Burnout

Note that some of the methods listed below may or may not apply to you. Some may also work better for you than others. This is to be expected, as everyone has their own unique needs. So, take care when trying things out to find out what will work for you and your own circumstances:

1. Spend some downtime with family and friends

David Seruya’s preferred method of de-stressing and preventing burnout is spending time with his family. He stated that he’s always been a family man and that he’s long admired his father for being able to juggle his work and personal life so well over the years.

His goal is to become just like his dad in this case and, as such, has always reserved time to spend with his family during the weekends — going as far as to completely cut himself off from his work emails and messages during breaks! In this way, he’s able to relieve some of the stress from work and separate himself from the burden of his responsibilities for a time.

It’s not a completely foolproof solution for some, as it doesn’t necessarily take care of the underlying causes of stress, but this method should at least help you start fresh mentally and be more prepared to deal with whatever is causing you so much troubles.

2. Organize your work and root out inefficiencies

The previous method is actually closely related to this one. More specifically, you need to get yourself into a better state so that you can effectively get your work back on track.

Most of the time, the reason for stress for business leaders is a failure in their own processes. This can take many forms, from something as simple as disorganized documents or rowdy employees causing trouble. Whatever it is, David Seruya suggests that you take the time to dig the rotten root out. By doing so, you can stand stronger and grow more comfortably.

3. Prioritize the most important tasks

Another thing that might be causing your issues is the fact that you have been inundated with tons of tasks and too little time to take care of them all. If so, then the first thing you should do is establish which of these tasks is most important to you and work on them correspondingly.

David Seruya stated that, if there is really no time to accomplish all tasks, then this would be the time to accept the fact that you won’t be able to get them all done. At which point, you should begin to look for alternative solutions or alert the client/customer accordingly.

4. Delegate tasks

One of the biggest mistakes a leader can make is not trusting their team enough to let them take on some heavier responsibilities. If that’s the case for you, then you need to seriously consider the people under your charge and whether or not you’re lack of trust is a result of their own failures or a failure to choose the right candidate for the job in the beginning.

Whatever the case may be, you need to figure out how to solve the problem so that you can have people at your disposal that you can rely on when things get rough.

5. Review your end goals

If what’s making you burn out is your state of mind, then a “refresh” in your thinking might help more than the other methods introduced thus far. For this, David Seruya suggests that you take a look at your end goal and the reward awaiting along with success. In this way, you can hopefully start to reinvigorate your spirits and focus on growing your business.

Business

13 Reasons Investors Are Watching Phoenix Energy’s Expansion in the Williston Basin

As energy security becomes a growing priority in the United States, companies focused on domestic oil production are gaining attention from investors. One such company is Phoenix Energy, an independent oil and gas company operating in the Williston Basin, a prolific oil-producing region spanning North Dakota and Montana.

Phoenix Energy has established itself as a key player in this sector, expanding its footprint while offering structured investment opportunities to accredited investors. Through Regulation D 506(c) corporate bonds, the company provides investment options with annual interest rates ranging from 9% to 13%.

Here are 13 reasons why Phoenix Energy is attracting investor interest in 2025:

1. U.S. energy production remains a strategic priority

The global energy landscape is evolving, with a renewed focus on domestic oil and gas production to enhance economic stability and reduce reliance on foreign energy sources. The Williston Basin, home to the Bakken and Three Forks formations, continues to play a critical role in meeting these demands. Phoenix Energy has established an operational footprint in the basin, where it is actively investing in development and production.

2. Investment opportunities with fixed annual interest rates

Phoenix Energy bonds offer accredited investors annual interest rates between 9% and 13% through Regulation D 506(c). These bonds help fund the company’s expansion in the Williston Basin, where it acquires and develops oil and gas assets.

3. Record-breaking drilling speeds in the Williston Basin

Phoenix Energy has made significant strides in drilling efficiency, ranking among the fastest drillers in the Bakken Formation as of late 2024. By reducing drilling times, the company aims to optimize operations and improve overall production performance.

4. Expansion of operational footprint

Since becoming an operator in September 2023, Phoenix Energy has grown rapidly. As of March 2025, the company has 53 wells drilled and 96 wells planned over the next 12 months.

5. Surpassing production expectations

Phoenix Energy’s oil production has steadily increased. By mid-2024, its cumulative production had exceeded 1.57 million barrels, outpacing its total output for 2023. The company projected an exit rate of nearly 20,000 barrels of oil equivalent per day by the end of March 2025.

6. High-net-worth investor offerings

For investors seeking alternative investments with higher-yield opportunities, Phoenix Energy offers the Adamantium bonds through Reg D 506(c), which provides corporate bonds with annual interest rates between 13% and 16%, with investment terms ranging from 5 to 11 years, and a minimum investment of $2 million.

7. Experienced team with industry-specific expertise

Phoenix Energy’s leadership and technical teams include professionals with decades of oil and gas experience, including backgrounds in drilling engineering, land acquisition, and reservoir analysis. This level of in-house expertise supports the company’s ability to evaluate acreage, manage operations, and execute its long-term development plans in the Williston Basin.

8. Focus on investor communication and understanding

Phoenix Energy prioritizes clear investor communication. The company hosts webinars and provides access to licensed professionals who walk investors through the business model and operations in the oil and gas sector. These efforts aim to help investors better understand how Phoenix Energy deploys capital across mineral acquisitions and operated wells.

9. Managing market risk through strategic planning

The energy sector is cyclical, and Phoenix Energy takes a structured approach to risk management. The company employs hedging strategies and asset-backed financing to help mitigate potential fluctuations in the oil market.

10. Commitment to compliance

Phoenix Energy conducts its bond offerings under the SEC’s Regulation D Rule 506(c) exemption. These offerings are made available exclusively to accredited investors and are facilitated through a registered broker-dealer to support adherence to federal securities laws. Investors can review applicable offering filings on the SEC’s EDGAR database.

11. Recognition for business practices

As of April 2025, Phoenix Energy maintains an A+ rating with the Better Business Bureau (BBB) and is a BBB-accredited business. The company has also earned strong ratings on investor review platforms such as Trustpilot and Google Reviews, where investors often highlight clear communication and transparency.

12. A family-founded business with a long-term vision

Led by CEO Adam Ferrari, Phoenix Energy operates as a family-founded business with a focus on long-term investment strategies. The company’s leadership emphasizes responsible growth and sustainable development in the Williston Basin.

13. Positioned for long-term growth in the oil sector

With U.S. energy demand projected to remain strong, Phoenix Energy is strategically positioned for continued expansion. The company’s focus on efficient drilling, financial discipline, and structured investment offerings aligns with its goal of building a resilient and growth-oriented business.

Final thoughts

For investors looking to gain exposure to the U.S. oil and gas sector, Phoenix Energy presents an opportunity to participate in a structured alternative investment backed by the company’s operational expansion in the Williston Basin.

Accredited investors interested in learning more can attend one of Phoenix Energy’s investor webinars, which are hosted daily throughout the week. These sessions provide insights into market trends, risk management strategies, and investment opportunities.

For more information, visit the Phoenix Energy website.

Phoenix Capital Group Holdings, LLC is now Phoenix Energy One, LLC, doing business as Phoenix Energy. The testimonials on review sites may not be representative of other investors not listed on the sites. The testimonials are no guarantee of future performance or success of the Company or a return on investment. Alternative investments are speculative, illiquid, and you may lose some or all of your investment. Securities are offered by Dalmore Group member FINRA/SIPC. Dalmore Group and Phoenix Energy are not affiliated. See full disclosures.

This article contains forward-looking statements based on our current expectations, assumptions, and beliefs about future events and market conditions. These statements, identifiable by terms such as “anticipate,” “believe,” “intend,” “may,” “expect,” “plan,” “should,” and similar expressions, involve risks and uncertainties that could cause actual results to differ materially. Factors that may impact these outcomes include changes in market conditions, regulatory developments, operational performance, and other risks described in our filings with the U.S. Securities and Exchange Commission. Forward-looking statements are not guarantees of future performance, and Phoenix Energy undertakes no obligation to update them except as required by law.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free