Tech

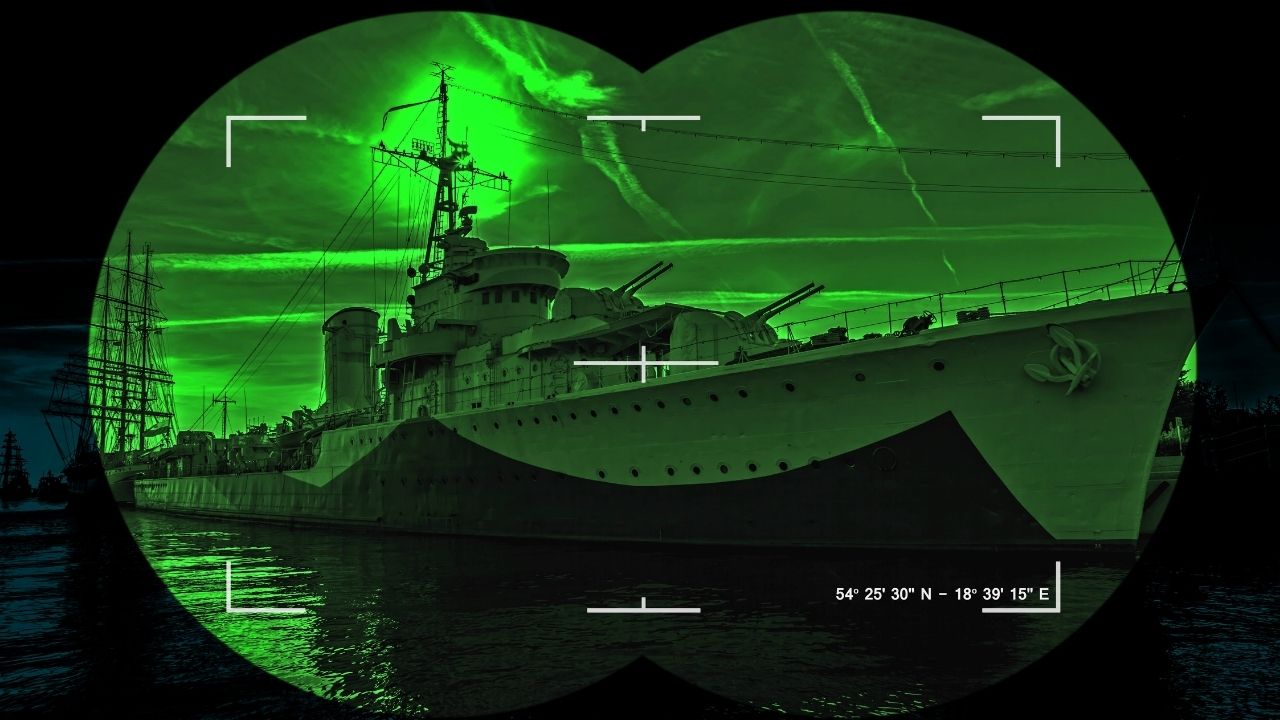

All you need to know about night vision optics.

One can see in black with both the night vision and infrared optics. They’re useful for a variety of tasks, such as nighttime hunting, spying, wildlife observation, navigating, astronomy, and strategic scenario practice. Knowing what nighttime vision glasses you’ll need would help you become more efficient at these tasks.

The type of night vision gear you need is determined by the application. One gets a tiny, comfortable grip and low light monoculars, which provides the device incredibly adaptable. Some variants can be directly mounted on guns and used as motion detection riflescopes. Nighttime glasses do not feature enlargement, but they do allow you to see things with both eyes, which improves image quality and distance judging. They can also be mounted mostly on the helmet, creating a convenient and perfect solution for night travel. Two eyepieces and a high built-in magnifying are included with low-light glasses.

The methodologies behind night-vision lenses

The capacity to see in nighttime situations is known as night vision. This is made feasible by a fusion of two methodologies: adequate spectrum range with adequate concentration range, either by natural or artificial methods. People possess limited night vision compared to many other species, in part due to the absence of an epithelial throughout the eye of a human being.

Night goggles have been the only way to see at night until picture intensifiers were introduced, and they were frequently used, primarily at seas. Night lenses from World War I typically seemed to have a lens length of around 56 mm or greater and zoom of nine or ten. The big weight, as well as the size of night lenses, are significant drawbacks.

Night vision gadget is indeed a military instrument that consists of just a picture intensifier lens enclosed in a hard housing. Night vision equipment has recently been more commonly available worldwide for civilian usage. For instance, better wearable devices for planes have been available to help pilots improve their situational awareness and avoid mishaps. Companies integrate these technologies in their most recent avionics kits. United States Navy has begun purchasing a version that includes a head display.

Can be used by people other than the military

These glasses are highly handy in a person’s daily life and also for usage at night. These could assist folks with their nighttime work routines. Other than armed personnel, these night vision spectacles have been made freely accessible to the general public. Some online websites, like http://www.defendandcarry.com, sell night vision goggles and other accoutrements. Night vision gadgets such as night vision lenses, clip on night vision lenses, and more are available on these websites.

This device can use a single intensifier channel to provide the same picture to the eyes, but it can also use a different slope intensifier tunnel one per eye. Night binoculars are made of night vision lenses and magnification lenses. Stereoscopic night vision gadgets with just one eyepiece, that might be installed on rifles at night times, are another form. Helicopter activities are increasingly using NVG technology to increase security.

Tech

The Importance of Cyber Hygiene: Tips from HelpRansomware Experts

Byline: Katreen David

In the digital age, the adage “an ounce of prevention is worth a pound of cure” has never been more relevant.

For Juan Ricardo Palacio and Andrea Baggio of HelpRansomware, the battle against digital threats is a daily reality. Founded in response to the growing menace of ransomware, HelpRansomware has made it its mission to recover data while educating the public on the importance of cyber hygiene.

“Preventing a cyberattack before it happens is crucial. We can safeguard digital assets more effectively by nipping the threat in the bud through vigilant monitoring and proactive measures,” says Baggio.

The Growing Threat of Cybercrime

Cyber threats have become increasingly pervasive and sophisticated, impacting businesses and individuals alike. According to research, there are an estimated 2,000 cyberattacks per day globally. This equates to over 800,000 cyber crimes annually. In line with this, the worldwide cost of cybercrime is projected to reach the $23 trillion mark by 2027.

This alarming figure highlights the critical need for robust cybersecurity practices. HelpRansomware has responded to this challenge by accentuating the importance of preventive measures. “Our goal is to create a safer digital environment where cyber hygiene is as natural as brushing your teeth,” says Palacio.

Cyber Clean: Maintaining Digital Hygiene

HelpRansomware advocates for a proactive outlook on cybersecurity. It offers practical tips for maintaining good cyber hygiene, such as regularly updating software, using strong and unique passwords, developing risk management plans, and educating employees about phishing scams.

“Cyber hygiene is about taking small, consistent actions to protect your digital assets,” explains Palacio. “When we practice good cyber hygiene, the chances of cyber attacks occurring shrink significantly.”

Businesses can significantly reduce cyberattack vulnerability by integrating these practices into daily routines.

HelpRansomware’s Role in Promoting Cyber Hygiene

Beyond recovery services, HelpRansomware is dedicated to raising awareness and providing education on cybersecurity best practices. It conducts workshops and seminars to help organizations understand the importance of cyber hygiene. This unique initiative mirrors the company’s sincere efforts toward shielding the world from the dark side of the web.

“Education is the first line of defense against cyber threats,” emphasizes Baggio. “Francis Bacon’s famous quote will always ring true in every industry: ‘Knowledge is power’.”

HelpRansomware’s efforts are power moves across the board that help businesses recover from attacks. Its checkmate move, however, is its vision to build a culture of prevention that can safeguard against future threats.

In an era where cyber threats lurk around every unlikely corner of the internet, the importance of cyber hygiene cannot be overstated. Through its innovative solutions and educational initiatives, HelpRansomware is leading the pack in promoting better cybersecurity practices. “We believe that a well-informed and vigilant community can defeat cybercrime,” concludes Baggio.

HelpRansomware’s proactive stance on cyber hygiene is setting new standards in the industry. Through education and preventive practices, Andrea Baggio and Juan Ricardo Palacio are fortifying the digital community, making sure that future cyber threats are met with informed and resilient defenses. Cleanliness matters in both the tangible and digital world.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free