Business

A Peek Into the Future of In-House Real Estate Financing with Christopher Aubin

Traditional lending practices often fall short, as evidenced by the 2008 housing crisis, as well as the current state of the real estate market. To help the everyday American finance their dream home, one company has adopted a strategy that may be the very future of real estate loans.

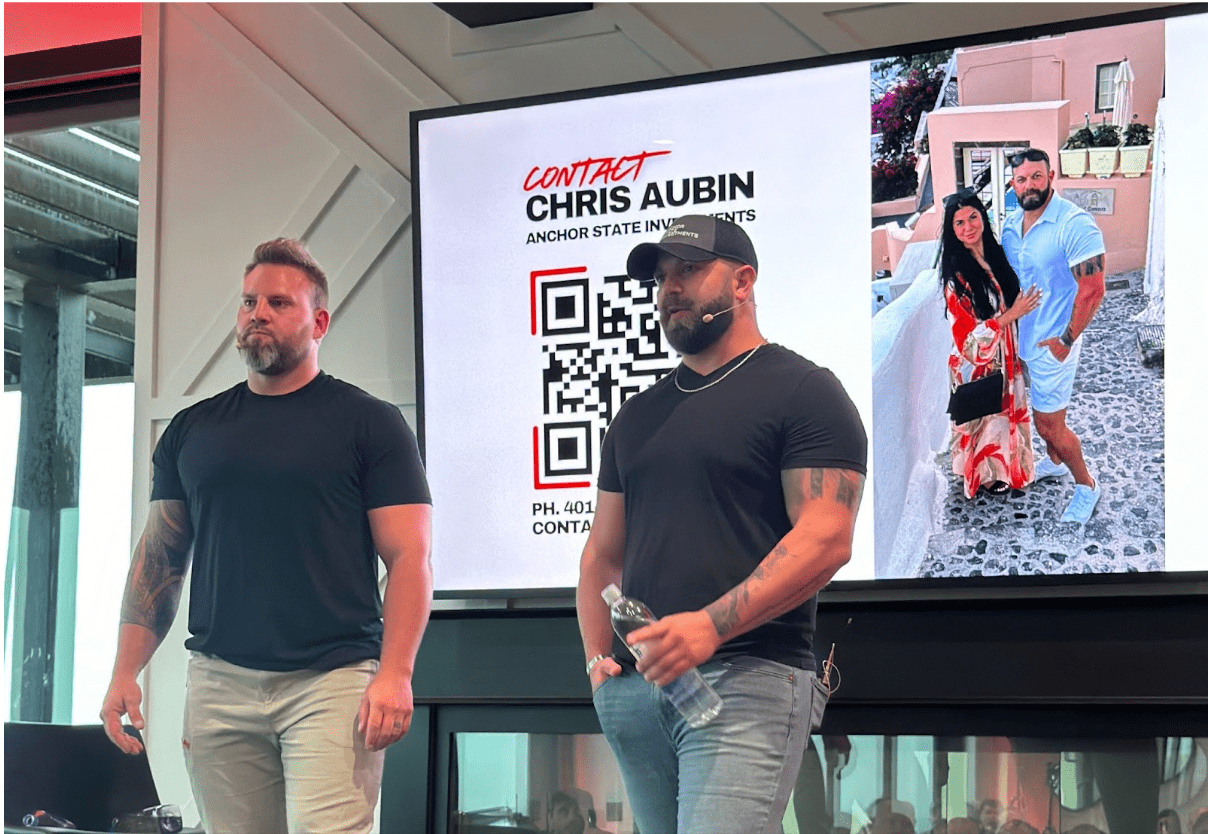

Anchor State Investments, led by CEO Christopher Aubin, offers a powerful solution through in-house financing.

Anchor State: Redefining Real Estate Financing

Aubin, a former Marine turned real estate mogul, founded Anchor State Investments with the mission to make homeownership accessible for all, especially those often overlooked by wider society, such as his fellow servicemen. The company’s strategy is an overarching one, combining property rehabilitation, financial education, and most notably, highly flexible capital options.

“We’re here to change lives by providing opportunities that traditional lenders often avoid,” Aubin states. “We aim to keep things hassle-free, quick, and fair. If you’re looking at rental property investment, exploring opportunities in fixer-upper projects, or embarking on new construction ventures, Anchor State’s got your back.“

Anchor State’s financing program is designed to offer fair, transparent lending options to those who may not qualify for the strict requirements of conventional mortgages. Providing competitive interest rates, flexible terms, and personalized financial counseling, the company hopes to revitalize homeownership as a concept itself.

Current Strategies and the Rise of In-House Financing

Traditionally, real estate purchases have been financed through banks, credit unions, and government-backed loans. However, these options often come with strict requirements, lengthy processes, and potentially predatory terms. In-house financing, on the other hand, offers a more streamlined and individualized option.

According to a recent study by the National Association of Realtors, in-house financing accounted for 12% of all real estate transactions in 2023, up from just 5% in 2020. This growth can be attributed to the increasing demand for flexible, accessible financing options.

“In-house financing is the future of real estate,” Aubin predicts. “By 2030, we expect it to be the primary financing method for at least 30% of all home purchases. Anchor State will lead the way.“

The Advantages of In-House Financing

In-house financing offers quite a number of benefits over traditional lending methods. First, in-house lenders can customize loan terms to fit individual needs, considering factors beyond just credit scores. Second, the application and approval process is often faster, as it’s handled directly by the real estate company. Third, in-house financing can provide opportunities for those with less-than-perfect credit or non-traditional income sources.

“Our goal is to say ‘yes’ when banks say ‘no,’” Aubin explains. “We believe everyone deserves a chance at homeownership, and in-house financing makes that possible.“

Anchor State’s in-house financing program has already made a significant impact. In 2023, the company financed over 150 home purchases, with an average interest rate 1.5% lower than the national average. Additionally, 90% of Anchor State’s in-house borrowers reported feeling more financially secure and empowered as homeowners.

With the affordable housing crisis impacting millions of families across the country, in-house financing is one of the most powerful solutions available to the average citizen. By 2025, the U.S. housing market is projected to need an additional 2.5 million affordable homes – many of which are financially out of reach for the average American.

“The future of real estate isn’t just in the hands of major developers,” Aubin concludes. “It has to be about people, about strengthening communities, and creating a path to financial freedom. That’s what in-house financing represents, and that’s what Anchor State is all about.“

Business

High Volume, High Value: The Business Logic Behind Black Banx’s Growth

In fintech, success no longer hinges on legacy prestige or brick-and-mortar branches—it’s about speed, scale, and precision. Black Banx, under the leadership of founder and CEO Michael Gastauer, has exemplified this model, turning its high-volume approach into high-value results.

The company’s Q1 2025 performance tells the story: $1.6 billion in pre-tax profit, $4.3 billion in revenue, and 9 million new customers added, bringing its total customer base to 78 million across 180+ countries.

But behind the numbers lies a carefully calibrated business model built for exponential growth. Here’s how Black Banx’s strategy of scale is redefining what profitable banking looks like in the digital age.

Scaling at Speed: Why Volume Matters

Unlike traditional banks, which often focus on deepening relationships with a limited set of customers, Black Banx thrives on breadth and transactional frequency. Its digital infrastructure supports onboarding millions of users instantly, with zero physical presence required. Customers can open accounts within minutes and transact across 28 fiat currencies and 2 cryptocurrencies (Bitcoin and Ethereum) from anywhere in the world.

Each customer interaction—whether it’s a cross-border transfer, crypto exchange, or FX transaction—feeds directly into Black Banx’s revenue engine. At scale, these micro-interactions yield macro results.

Real-Time, Global Payments at the Core

One of Black Banx’s most powerful value propositions is real-time cross-border payments. By enabling instant fund transfers across currencies and countries, the platform removes the frictions associated with SWIFT-based systems and legacy banking networks.

This service, used by individuals and businesses alike, generates:

- Volume-based revenue from transaction fees

- Exchange spreads on currency conversion

- Premium service income from business clients managing international payroll or vendor payments

With operations in underserved regions like Africa, South Asia, and Latin America, Black Banx is not only increasing volume—it’s tapping into fast-growing financial ecosystems overlooked by legacy banks.

The Flywheel Effect of Crypto Integration

Crypto capabilities have added another dimension to the company’s high-volume model. As of Q1 2025, 20% of all Black Banx transactions involved cryptocurrency, including:

- Crypto-to-fiat and fiat-to-crypto exchanges

- Crypto deposits and withdrawals

- Payments using Bitcoin or Ethereum

The crypto integration attracts both retail users and blockchain-native businesses, enabling them to:

- Access traditional banking rails

- Convert assets seamlessly

- Operate with lower transaction fees than those found in standard financial systems

By being one of the few regulated platforms offering full banking and crypto support, Black Banx is monetizing the convergence of two financial worlds.

Optimized for Operational Efficiency

High volume is only profitable when costs are contained—and Black Banx has engineered its operations to be lean from day one. With a cost-to-income ratio of just 63% in Q1 2025, it operates significantly more efficiently than most global banks.

Key enablers of this cost efficiency include:

- AI-driven compliance and customer support

- Cloud-native architecture

- Automated onboarding and KYC processes

- Digital-only servicing without expensive physical infrastructure

The outcome is a platform that not only scales, but does so without sacrificing margin—each new customer contributes to profit rather than diluting it.

Business Clients: The Value Multiplier

While Black Banx’s massive customer base is largely consumer-driven, its business clients are high-value accelerators. From SMEs and startups to crypto firms and global freelancers, businesses use Black Banx for:

- International transactions

- Multi-currency payroll

- Crypto-fiat settlements

- Supplier payments and invoicing

These clients tend to:

- Transact more frequently

- Use a broader range of services

- Generate significantly higher revenue per user

Moreover, Black Banx’s API integrations and tailored enterprise solutions lock in these clients for the long term, reinforcing predictable and scalable growth.

Monetizing the Ecosystem, Not Just the Account

The genius of Black Banx’s model is that it monetizes not just accounts, but entire customer journeys. A user might:

- Onboard in minutes

- Deposit funds from a crypto wallet

- Exchange currencies

- Pay an overseas vendor

- Withdraw to a local bank account

Each of these actions touches a different monetization lever—FX spread, transaction fee, crypto conversion, or premium service charge. With 78 million customers doing variations of this at global scale, the cumulative financial impact becomes immense.

Strategic Expansion, Not Blind Growth

Unlike many fintechs that chase customer acquisition without a clear monetization path, Black Banx aligns its growth with strategic market opportunities. Its expansion into underbanked and high-demand markets ensures that:

- Customer acquisition costs stay low

- Services meet genuine needs (e.g., cross-border income, crypto access)

- Revenue per user grows over time

It’s not just about acquiring more customers—it’s about acquiring the right customers, in the right markets, with the right needs.

The Future Belongs to Scalable Banking

Black Banx’s ability to transform high-volume engagement into high-value profitability is more than just a fintech success—it’s a signal of what the future of banking looks like. In a world where agility, efficiency, and inclusion define competitive advantage, Black Banx has created a blueprint for digital banking dominance.

With $1.6 billion in quarterly profit, nearly 80 million users, and services that span the globe and the blockchain, the company is no longer just scaling—it’s compounding. Each new user, each transaction, and each feature builds upon the last.

This is not the story of a bank growing.

This is the story of a bank accelerating.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free