Tech

Florida Beach To Use New App, Upload Crime Videos To Police

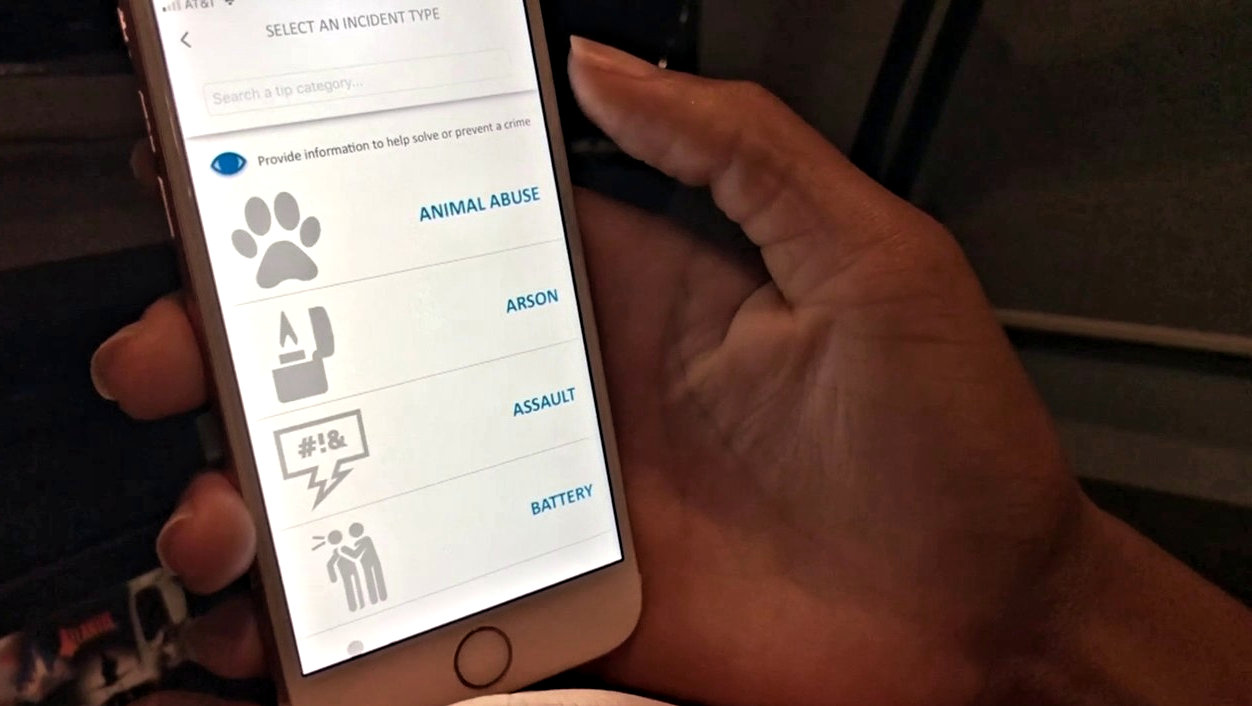

For the last decade the world has been watching various crimes and ignorant acts on viral videos. Sites like WorldStarHipHop.com and LiveLeaks made millions of dollars hosting such content. ‘Clout chasers’ turned into stars from the acts. These videos may not be so cool soon however if the new app announced by a Jacksonville community catches on. Atlantic Beach in Florida will allow users to upload videos of crimes directly to Police (Jax news) via the new app, SaferWatch.

Why Patrol When Citizens Can

The Police Department for Atlantic Beach, in Jacksonville’s metro, think citizens can have a bigger role in making the community safer. The new SaferWatch app will allow people to record and submit video recordings of crimes that are taking place. Hopefully this will give police an upper hand in putting faces and people at the place of crime scenes or catch them in the act.

The process to upload will be similar to that of the WorldStarHipHop application. Once a user opens the program, the video recording unit will appear on their smart device. From there, Smartwatch users can record and upload the video with details of what’s going on. The media file uploaded will be sent to Atlantic Beach police, who aim to increase safety in the area for tourism.

Videos of Crimes Soon To Be Profitable for Police?

A question in the minds of some is who will own the content of ‘criminals gone wild’ at the beach. Whomever has rights to the content will be able to possibly create a website similar to that of LiveLeaks , in more ‘tame’ fashion. The site which shows this content could place ads or other promotional materials to earn money from the shocking videos.

While this may sound like a bad idea, perhaps it is not. Such new revenues to a Police Department could possibly help them stop with the pressuring of local drivers at the end of the month, when they have to make profit quotas. It is no secret to Americans that cops turn to ‘petty ticketing tactics’ when a precinct needs to make their minimum revenue goals, that determine the end of the year bonuses. A website earning five figures monthly could help kill the need for this type of behavior.

Why This Beach is Growing

If not aware, Atlantic is one of the hottest beaches in the Southeast with tourism in 2019. That is meant both literally and figuratively. People are taking full advantage of campgrounds there to set up tents and enjoy nature, much like the trend taking over Atlanta. Parks like Kathtryn Abbey Hanna, Lil’ Talbot Island, Camp Chowenwaw, Fort Clinch, and Huguenot have become hotspots for people who like to pack the jeep, turn on the music, and ride to a destination without technology. Newbies can easily take a look at the Seaside Planet’s “Best Beach Tent of 2019: Complete Reviews with Comparison” page to take part in the action.

Alongside this, the marine life is thriving. Both fishermen, Surfers, and tourists are enjoying the site of rarely viewed animals for inlanders. Charter companies are being slammed with booking this summer to go after large marine game fish while water sports athletes are lining up to join the “Surf Into Summer” program. Just yesterday a 5 foot shark was caught by a shore fisherman on the beach which had crowds buzzing in amazement.

See a video below of a 16 foot shark named “Mary Lee” who passed within 600 feet of Jacksonville Beach in 2013. Download “Safewatch” app on your phone today to help capture crimes around the Atlantic Beach area.

Video(s) to embed:

Tech

The Importance of Cyber Hygiene: Tips from HelpRansomware Experts

Byline: Katreen David

In the digital age, the adage “an ounce of prevention is worth a pound of cure” has never been more relevant.

For Juan Ricardo Palacio and Andrea Baggio of HelpRansomware, the battle against digital threats is a daily reality. Founded in response to the growing menace of ransomware, HelpRansomware has made it its mission to recover data while educating the public on the importance of cyber hygiene.

“Preventing a cyberattack before it happens is crucial. We can safeguard digital assets more effectively by nipping the threat in the bud through vigilant monitoring and proactive measures,” says Baggio.

The Growing Threat of Cybercrime

Cyber threats have become increasingly pervasive and sophisticated, impacting businesses and individuals alike. According to research, there are an estimated 2,000 cyberattacks per day globally. This equates to over 800,000 cyber crimes annually. In line with this, the worldwide cost of cybercrime is projected to reach the $23 trillion mark by 2027.

This alarming figure highlights the critical need for robust cybersecurity practices. HelpRansomware has responded to this challenge by accentuating the importance of preventive measures. “Our goal is to create a safer digital environment where cyber hygiene is as natural as brushing your teeth,” says Palacio.

Cyber Clean: Maintaining Digital Hygiene

HelpRansomware advocates for a proactive outlook on cybersecurity. It offers practical tips for maintaining good cyber hygiene, such as regularly updating software, using strong and unique passwords, developing risk management plans, and educating employees about phishing scams.

“Cyber hygiene is about taking small, consistent actions to protect your digital assets,” explains Palacio. “When we practice good cyber hygiene, the chances of cyber attacks occurring shrink significantly.”

Businesses can significantly reduce cyberattack vulnerability by integrating these practices into daily routines.

HelpRansomware’s Role in Promoting Cyber Hygiene

Beyond recovery services, HelpRansomware is dedicated to raising awareness and providing education on cybersecurity best practices. It conducts workshops and seminars to help organizations understand the importance of cyber hygiene. This unique initiative mirrors the company’s sincere efforts toward shielding the world from the dark side of the web.

“Education is the first line of defense against cyber threats,” emphasizes Baggio. “Francis Bacon’s famous quote will always ring true in every industry: ‘Knowledge is power’.”

HelpRansomware’s efforts are power moves across the board that help businesses recover from attacks. Its checkmate move, however, is its vision to build a culture of prevention that can safeguard against future threats.

In an era where cyber threats lurk around every unlikely corner of the internet, the importance of cyber hygiene cannot be overstated. Through its innovative solutions and educational initiatives, HelpRansomware is leading the pack in promoting better cybersecurity practices. “We believe that a well-informed and vigilant community can defeat cybercrime,” concludes Baggio.

HelpRansomware’s proactive stance on cyber hygiene is setting new standards in the industry. Through education and preventive practices, Andrea Baggio and Juan Ricardo Palacio are fortifying the digital community, making sure that future cyber threats are met with informed and resilient defenses. Cleanliness matters in both the tangible and digital world.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free